what is the inheritance tax rate in virginia

The tax rate varies. West Virginia is fairly tax-friendly for retirees.

Hawaii and washington state have the.

. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth. In general all sales leases and rentals of tangible personal property in or for use in Virginia as well as accommodations and certain taxable services are subject to Virginia sales and use tax. But just because Virginia does not have an estate tax does not.

Ad Virginias 1 online provider. This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381. Virginia does not have an inheritance tax.

This is great news for Virginia residents. By 2010 Congress raised that exemption threshold to 5000000 and as of 2017 the threshold rose to 5490000. Gift tax and inheritance tax in West Virginia.

The estate tax was imposed on the transfer of a taxable estate at a rate equal to the maximum amount of the federal credit for state estate taxes as it existed on January 1. And married couples may each claim the exemption. In the letter case the inheritance becomes subject to.

Unlike the federal government Virginia does not have an estate tax. Content updated daily for virginia inheritance tax rates. The rate threshold is the point at which the marginal estate tax rate kicks in.

Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. With the elimination of. Ad Looking for virginia inheritance tax rates.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. Just click print sign. There is no gift tax in West Virginia and this fact became an essential part of the estate planning strategy for people with.

The tax is assessed at the rate of 10 cents per 100 on estates valued at more than 15000 including the first 15000 of assets. The tax is assessed at the rate of 10 cents per 100 on estates valued at more than 15000 including the first 15000 of assets. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

How much can you inherit without paying taxes in 2020. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. Today Virginia no longer has an estate tax or inheritance tax.

Overall West Virginia Tax Picture.

Inheritance Tax Here S Who Pays And In Which States Bankrate

Inheritance Tax Here S Who Pays And In Which States Bankrate

The Death Tax Taxes On Death American Legislative Exchange Council

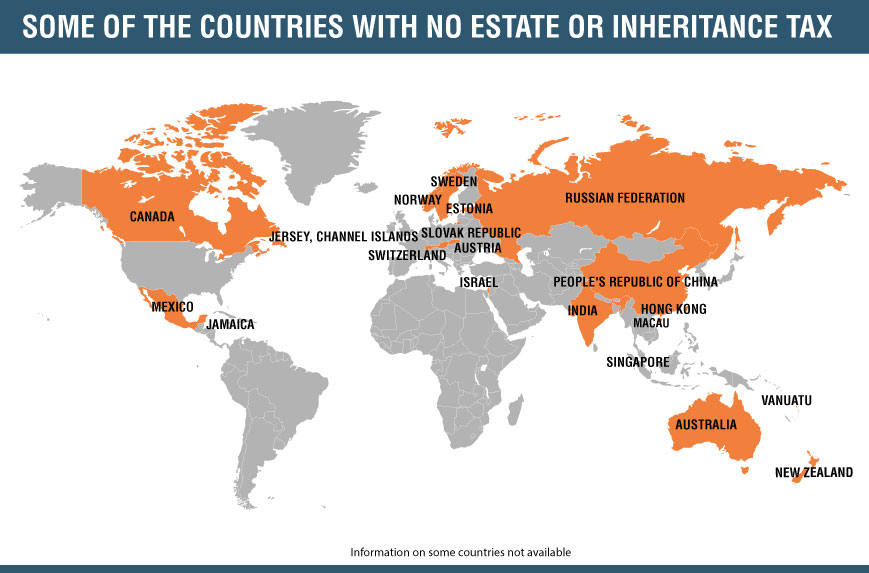

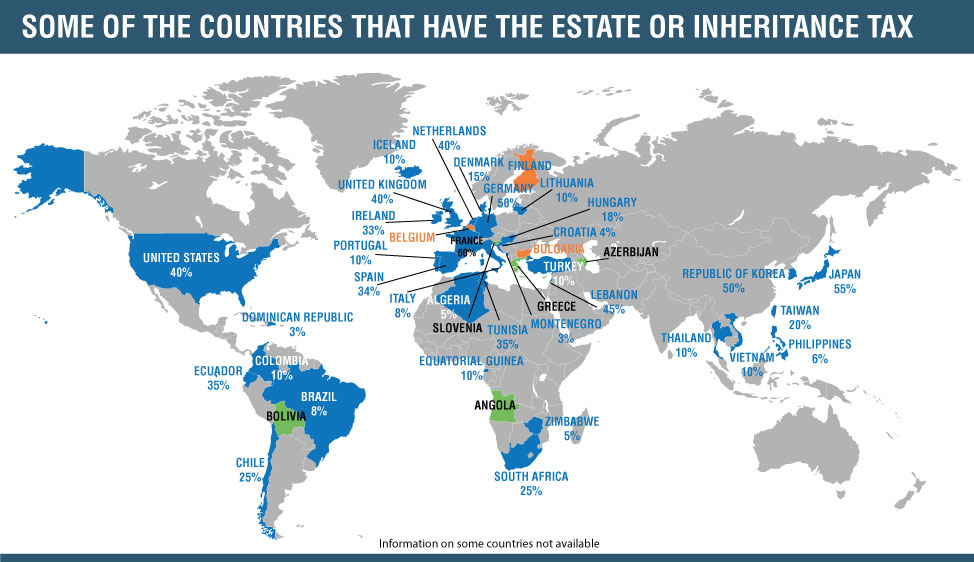

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

States With No Estate Tax Or Inheritance Tax Plan Where You Die

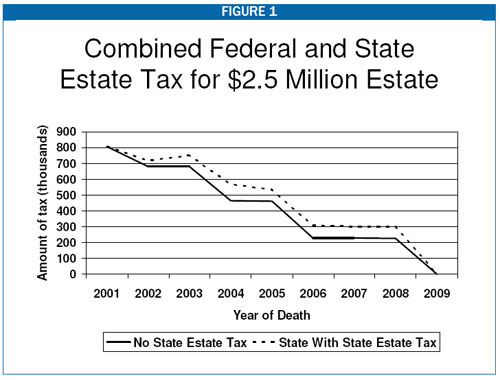

Assessing The Impact Of State Estate Taxes Revised 12 19 06

States With No Estate Tax Or Inheritance Tax Plan Where You Die

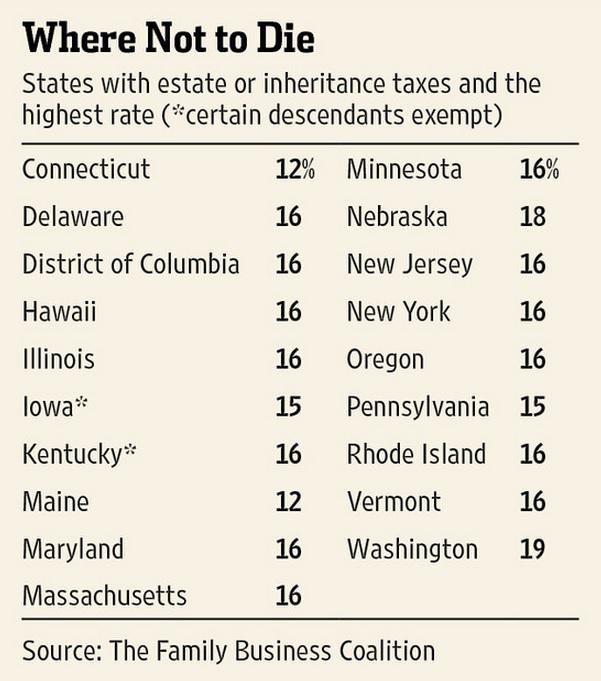

In Addition To The Federal Estate Tax With A Top Rate Of 40 Percent Some States Levy An Additional Estate Or Inheritan In 2022 Inheritance Tax Estate Tax Inheritance

California Estate Tax Everything You Need To Know Smartasset

2020 Estate And Gift Taxes Offit Kurman

What Is Inheritance Tax Probate Advance

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Taxes On Inherited Wealth Center On Budget And Policy Priorities